Does free credit card processing sound attractive? We bet it does. While you put a lot of effort and money into establishing your business, you’ll gladly skip extra spending. Though it sounds like heaven on earth, there are still some peculiarities to this question.

In this article, we are going to discuss all the aspects involved in the process. How does the zero cost model affect you? Should your customers pay then? Well, is it even possible to have no charges at all? Keep on reading to find the answers.

Getting a closer look at zero fees

What fees do merchants pay?

Market relations define the “merchant-payment processor” communication. Basically, you pay for the services the payment processing company offers you. And this payment is what we call a fee. Commonly, merchants meet the following fees:

- Set up fee

- Monthly fee

- Interchange fee

- PCI DSS compliance fee, etc.

They define the final amount you pay for partnering with the payment service provider. And while you see the list, you may think, “Where is my zero fee?” Sure, it doesn’t come out of anywhere. So, it’s up to the payment processor what to charge (or not) for the setup, etc. Still, they can’t eliminate the interchange fee. It’s time to learn a bit more about the interchange fee.

Why do merchants pay the interchange fee?

You let your clients pay with credit cards. That’s why you have to pay to the credit card network. And the interchange fee is included in that payment. Plus, it is the biggest one. On top of that, neither you nor your payment processor can negotiate this fee.

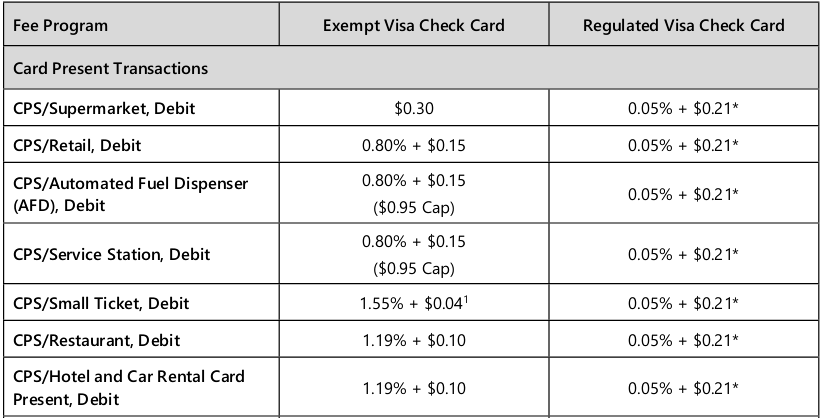

Visa, Mastercard, Amex, and Discover establish this fee. They may vary based on the industry. For instance, Visa and Mastercard are pretty transparent about the fees they charge. Here is a screenshot from Visa to give you an idea of the rates they have for the US.

And though you do not pay this fee directly to Visa itself, you have it among other merchants’ fees. If you have to pay this fee, how is the zero fee even possible?

Is free credit card processing possible?

So, the payment processor says you can pay no fee. But as we’ve just written, there are different charges merchants can expect. Well, there are certain ways to pay no fee, and you can get an idea after looking at the definition.

Zero fee or zero cost credit card processing is a payment solution when the processing fees are passed to clients.

Accordingly, as a business owner, you pass the charge to your customers. As clients pay for the goods/services you offer, they will pay an extra fee. And while you can get rid of one part of the fees only, you still might need to pay the others. We’ve mentioned them – setup/monthly/other fees.

You technically have no cost for credit card processing. But surcharging is what you do to your clients.

You might also like: What is a convenience fee and should you charge it?

What is surcharging all about?

So, the fees’ displacement is an essence of surcharging. You can opt for it regardless of the bank or credit card network. Nevertheless, the surcharging will work for the credit cards only. So, if you think about “how I can reverse my fees,” credit cards are the only option.

Also, you should keep in mind that there are certain surcharging rules and regulations. For instance, let’s look at how Visa US puts it.

- Merchants may surcharge across all the United States. There are restrictions in ten states. Some of them are California, Florida, Kansas, Massachusetts, New York, and Texas.

- The seller needs to notify Visa that s/he is going to surcharge. They should do it one month before introducing surcharging to customers.

- Merchants may surcharge credit cards only.

- Merchants must notify the clients that there is an extra fee. They do it near the POS terminal or clearly on the website.

- Visa advises merchants to research before implementing the fee to consider the advantages and the disadvantages.

We believe the last point is pretty important. We’d like to talk more detailed about it.

Does free credit card processing fit my business?

Getting free merchant services is what any business owner will eagerly accept. But now you can see that it has some particularities. Before searching for this processing type and handling charges to your clients, think of the following points.

- How this influences your customers’ behavior & experience. The study says, 64.5% of shoppers have no wish to pay any fees. Keep this number in mind when you make a decision. There’s always a risk of losing clients, which negatively influences your income.

- Take a look at how your competitors act. Is it typical for your industry to surcharge? Do your rivals do this? Then you are safe. In case, if that is an unusual practice, your clients may find a substitution. Of course, if you don’t sell something unique.

Once again, we remind that surcharging works for credit cards only. If debit or prepaid cards are the typical payment methods for your industry, this option won’t work for you.

You need to understand: it’s more about the fee shift. Payment processing companies won’t cut the price for you and harm themselves. Those who claim covering everything for you are probably embellishing the reality.

You might also like: How to minimize PSP fees

How do I keep the payment processing fees low?

If the zero cost processing fits you, you are free to go ahead. But what if the stats show that your customers pay with debit cards and don’t like extra charges?

Then you need to select a reliable payment processor. We, at Ikajo International, try to keep our fees affordable for any business size and type. For instance, the rates start at 1.2%, and we do not charge for recurring billing.

Moreover, thanks to the smart routing option, we connect the merchants to the banks with the lowest fees. It’s possible in the essence of 60+ acquiring banks we have in our global network.

Conclusions

Free credit card processing may sound like a solution for all of your problems. Yet, as we look closer, it seems to be not such a sure thing. To avoid zero fee solutions complaints, we’ve tried to sort out the theme.

Now, as you see what techniques stand behind zero cost processing, you’ll think twice. Firstly, do research. If your rivals use the same option, zero fee processing is most likely to fit you. In case if surcharging is what your customer won’t tolerate, choose another option.

Which solution should you pick then? Open a merchant account with Ikajo International. We offer affordable pricing and flexible fee structure.