Providing clients with a secure and fast payment method is as important as defining your core product. Hence, a payment gateway is a tool that holds up to 50% of your e-commerce store’s success. But with so many options presented, how does one know that he is choosing the right one? The decision of whom to confide your payment information is always a difficult one. That is why we offer you our expert help. Let’s look at our top five payment gateways comparison.

Top 5 payment gateways comparison

Let’s first specify the core characteristics of a payment gateway:

- Payment processing speed. The speed of funds transfers from your clients to your bank account upon the purchase.

- Merchant account. A merchant account is an agreement between a merchant and an acquiring bank. This agreement allows the former to process and accept credit card payments. By signing this agreement, a merchant agrees to abide by the operating regulations established by Visa, MasterCard, or any other brand. Some PSPs request a merchant account while others don’t.

- Payment methods. From credit and debit cards to digital wallets, all the payment gateways have a different range of payment methods available.

- Hosted or integrated. This feature shapes the customer’s payment journey. A hosted payment gateway allows a customer to complete the purchase without leaving the website. Integrated ones require redirects.

- Fee structure. The cost of setup, cancellation, chargeback and, per-transaction fees, monthly usage charges, microtransactions fee (transactions under $10), etc. vary from company to company. And they often determine the client’s choice of a PSP.

- Recurring billing. In other words, it’s an ability to charge a fixed fee on a monthly basis. Recurring billing is a must for those who offer subscriptions, premium content, online courses, etc.

- Security compliance. Security compliance in the form of PCI DSS, Fraud and Chargeback prevention certificates, etc. . is a must for both the merchant’s and client’s financial safety.

- Plugins. Some PSPs offer ready-made plugins for Shopify, WooCommerce, and other e-commerce platforms. This option is a door of opportunity for those who don’t want to bother creating a website from scratch.

- Mobile payments. Customers spoiled with one-click payments expect this payment method from a PSP. After all, 79% of smartphone users have made a purchase online using their mobile device in the last 6 months

- Supported currencies. Those aiming to penetrate the global market should take a good note of currencies range. An ability to pay in a local currency saves customer’s money and increases his support and trust in the brand.

- A number of countries a payment gateway operates in. The cooperation with local acquiring banks speeds up the process of funds transferring and saves merchants money. Thus, define your geo-preferences before making a final decision

- Cooperation with high-risk businesses. Not all of the PSPs are willing to deal with the high-risk niche. Binary options, betting and gambling, pharmaceuticals, CBD oil, tobacco, adult entertainment, file sharing, cyberlockers, and skill games are but a few examples of businesses PSPs are reluctant to offer their services to. For more information, take a look at this article.

Let’s now dig into the comparison of the top five payment gateways based on the criteria mentioned above.

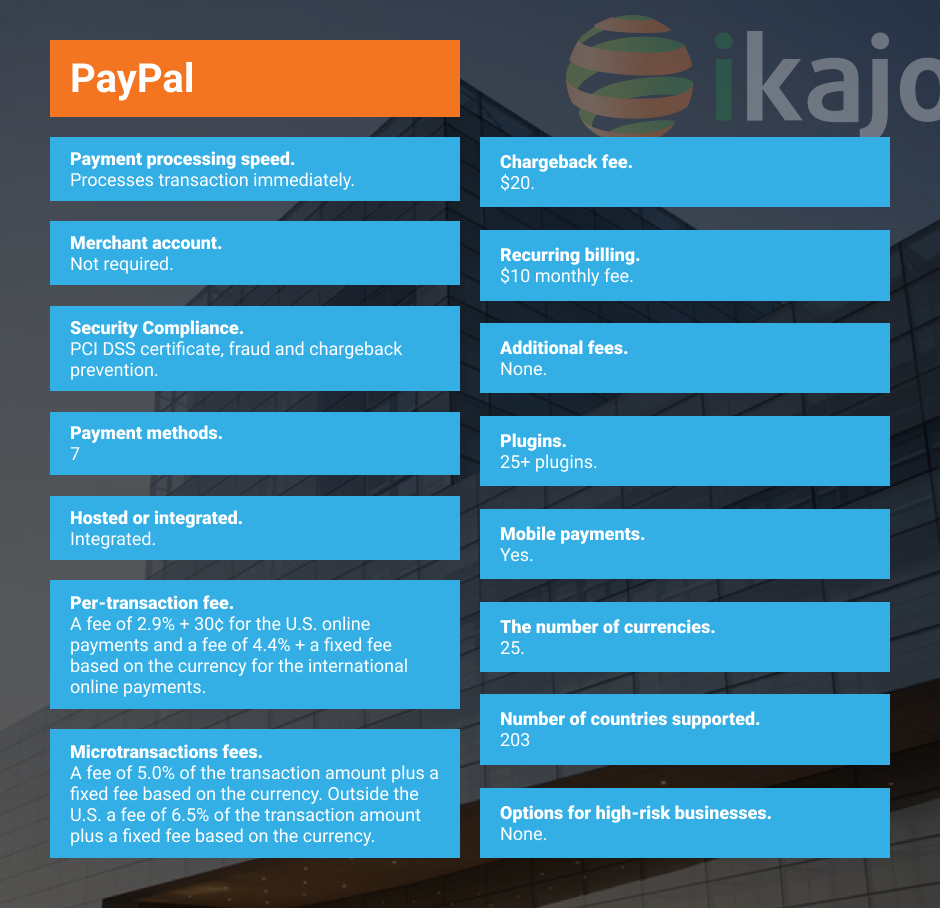

PayPal

- Payment processing speed. Processes transactions immediately.

- Merchant account. Not required.

- Security Compliance. PCI DSS certificate, fraud and chargeback prevention.

- Payment methods. 7

- Hosted or integrated. Integrated.

- Per-transaction fee. A fee of 2.9% + 30¢ for the U.S. online payments and a fee of 4.4% + a fixed fee based on the currency for the international online payments.

- Microtransactions fees. A fee of 5.0% of the transaction amount plus a fixed fee based on the currency. Outside the U.S. a fee of 6.5% of the transaction amount plus a fixed fee based on the currency.

- Chargeback fee. $20

- Recurring billing. $10 monthly fee.

- Additional fees. None.

- Plugins. 25+ plugins.

- Mobile payments. Yes.

- The number of currencies. 25.

- A number of countries supported. 203.

- Options for high-risk businesses. None.

Related article: Top 10 PayPal alternatives

Stripe

- Payment processing speed. Processes transactions immediately.

- Merchant Account. Not required.

- Security Compliance. PCI DSS certificate, fraud and chargeback prevention.

- Payment methods. 23

- Hosted or integrated. Integrated.

- Per-transaction fee for merchants. A fee of 2.9% + $.030 for the U.S. online payments and a fee of 1% +2.9% + a fixed fee based on currency for the international online payments.

- Chargeback fee. $15.

- Recurring billing. A free or paid plugin for $39.95.

- Additional fees. None.

- Plugins. 25+.

- Mobile payments. Yes.

- The number of currencies. 100+.

- A number of countries supported. 25.

- Options for high-risk businesses. None.

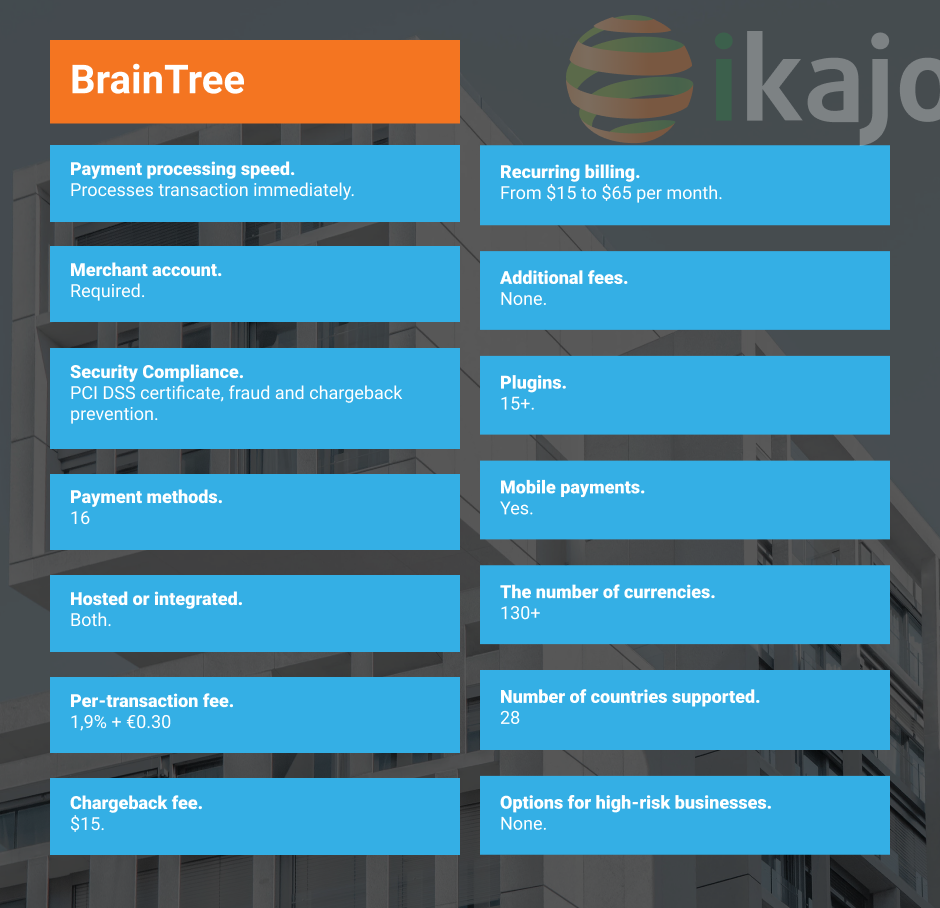

BrainTree

- Payment processing speed. Processes transactions immediately.

- Merchant account. Required.

- Security compliance. PCI DSS certificate, fraud and chargeback prevention.

- Payment methods. 16

- Hosted or integrated. Both.

- Per-transaction fee for merchants. 2.9% + $0.30

- Chargeback fee. $15.

- Recurring billing. From $15 to $65 per month.

- Additional fees. None.

- Plugins. 15+

- Mobile payments. Yes.

- The number of currencies. 130+.

- A number of countries supported. 28.

- Options for high-risk businesses. None.

Ikajo International

- Payment processing speed. Processes transactions immediately.

- Merchant account. Required. It can be obtained with the assistance of a PSP.

- Security compliance. PCI DSS certificate, fraud and chargeback prevention.

- Payment methods. 100+

- Hosted or integrated. Both.

- Per-transaction fee for merchants. 1.2%

- Chargeback fee. $45

- Recurring billing. Free.

- Additional fees. $300 setup fee.

- Plugins. Shopify plugin.

- Mobile payments. Yes.

- The number of currencies. 100+

- A number of countries supported. 150+

- Options for high-risk businesses. Gambling.

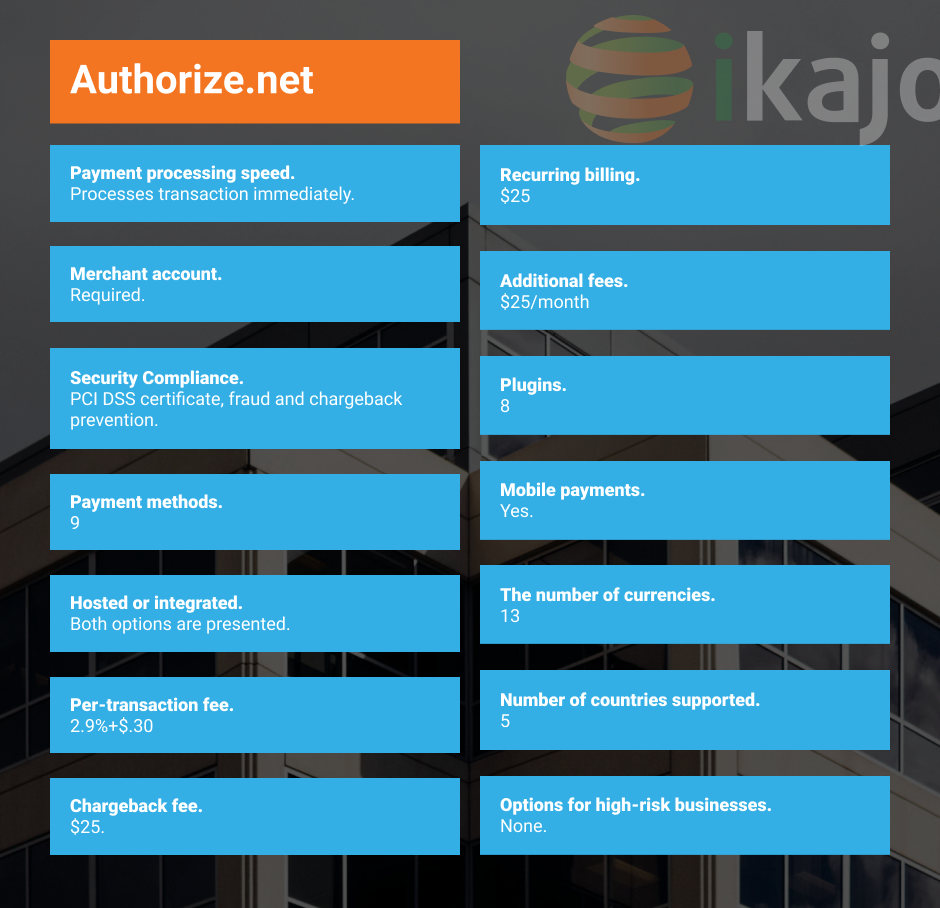

Authorize.net

- Payment processing speed. Processes transactions immediately.

- Merchant account. Required.

- Security compliance. PCI DSS certificate, fraud and chargeback prevention.

- Payment methods. 9

- Hosted or integrated. Both options are presented.

- Per-transaction fee for merchants. 2.9%+$.30

- Chargeback fee. $25

- Recurring billing. $25

- Additional fees. $25/month

- Plugins. 8

- Mobile payments. Yes.

- The number of currencies. 13

- A number of countries supported. 5

- Options for high-risk businesses. None.

Conclusion

To sum up, PayPal is the best option for the U.S. dropshipping as it has low microtransactions fees (those less or equal to $10). However, its high commissions make it unfavorable for international businesses. Stripe and Ikajo International, on the contrary, offer beneficial conditions for those willing to dominate the global market.

Being a reliable option to consider, Stripe only functions in 25 countries, while Ikajo International exerts its influence in 250+ countries. With regard to Braintree and Authorized.net, both companies are secure and profitable for merchants. The paid recurring billing and a limited number of countries they operate in are among their only disadvantages.

Meanwhile, Ikajo International offers the lowest fees starting at 1.2% while all the other PSPs charge 2.9% + $.030 per transaction. However, it’s brand name is less familiar to the global audience.

Choose what fits your business needs best. And keep in mind that there are no limits that a determined go-getter can’t overcome.