You’ve probably heard the advice of getting a virtual terminal account a million times. Yet, something has always been holding you back from getting one.

You have been wondering how it works, how safe it is to use this technology, and whether the banks will want to work with you and allow you accept credit card payments this way.

We can totally relate to your situation.

However, we have decided to dig a little deeper and offer you our professional insight into the virtual terminal, its benefits and what businesses should use it.

Before showing you all its benefits, let’s go over the basics and determine what a virtual terminal is.

What is a virtual terminal account?

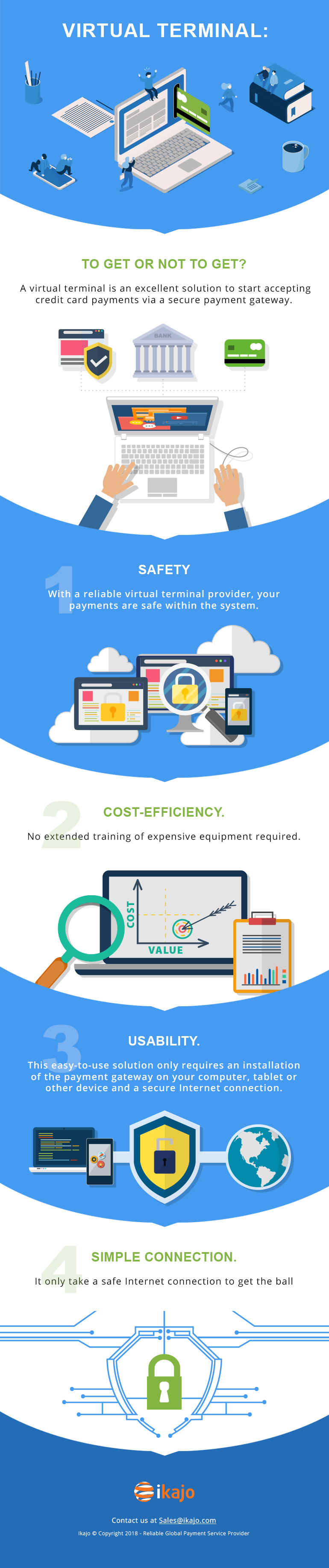

A virtual terminal is an excellent solution for merchants willing to accept credit card payments without paying extra money for additional equipment.

The secret hides in principle behind the virtual terminal. It functions in the same way as a credit card swiper, only on a personal computer or a tablet with the aid of a specialized payment gateway.

It’s also worth mentioning that MOTO transactions are considered part of the Virtual Terminal functionality.

You might also like In-app payments pros and cons

What are the MOTO transactions?

To put it short, MOTO (Mail Order / Telephone Order) transactions are “card-not-present” transactions. Usually, in this case, a cardholder provides the merchant with his credit card details over the mail or the telephone. The merchant then inserts this information into the relevant fields. That’s how the purchase is being made.

In case the merchant uses a regular credit card swiper, the transaction is no MOTO. It becomes a regular credit card transaction.

How a virtual terminal account works

All you have to do to get things started with the virtual terminal is:

- Log into the secure payment gateway using your unique credentials;

- Gather client’s credit card details essential to make the payment;

- Enter these details into relevant fields;

- Click on the “Submit” button.

That’s it; as long as the customer provided you with the valid credit card details, you’ve got the ball rolling. Wait up for the information from the system on whether the payment details were accepted or not: typically, it takes just a couple of seconds.

This is what the process looks like on the client’s side. The information flow behind these simple four steps is somewhat similar to the flow inside a payment gateway which we described in our previous article.

In case of a successful transaction, the funds withdrawn from the customer’s account will be credited to the merchant’s account within one or two business days.

Why every business needs a virtual terminal account

Everything we said above sounds just great. However, if you still have questions on why you should opt for this way of accepting credit cards, we’ve got it all covered in our list of benefits.

- It is safe.

We surely want you to be wise when choosing a virtual terminal software provider. However, if you do your homework, search the web for reviews and choose the best company to work with, a virtual terminal account is safe to use. - It is cost-efficient

It is just as safe as a conventional credit card swiper, yet it does not require specialized training for the employees or expensive equipment. Only a USB card swiper and software to install onto a laptop or a tablet.

So, why paying more for services you can cut your expenses on? - It is easy-to-use.

Your employees will be grateful if you give them a chance to work with the virtual terminal account. All they need to do is make sure they fill in the forms with correct credit card details. No training to take or puzzles to solve as they use the virtual terminal. - It only takes an Internet connection to get started.

Once the payment gateway is installed, the merchant only has to turn the Internet on to use the virtual terminal account to accept payments.

Sure thing, it should by no means be the connection with Public access. Use your own private connection. It is crucial to the safety of the data you transfer within the system.

Over to you

These are but a few reasons that make a virtual terminal account an excellent solution for merchants looking for ways to start accepting credit card payments. Should you still doubt, do not hesitate to contact us at [email protected] to get more information on this payment processing solution.