In today’s article, we are talking about how to secure payments online. This issue has gained an all-time high, due to annual losses of $6 trillion caused by cybercrime.

75% of businesses want to have advanced and sophisticated ways to safeguard transactions. Still, most of them stick to good old passwords which are no longer enough given the sophisticated approach of modern cybercriminals. That is why we are sharing five proven ways to secure online payments.

Trust us, we are going far beyond passwords and ready to offer solutions that fit different business types. You will learn how they work and how to implement them to protect your clients and your business.

Introducing five tested ways to secure payments online

1. Ensure PCI DSS compliance

Payment card fraud will cause $34.6 billion of worldwide losses by 2022. Why is PCI DSS compliance so important? Because its main goal is to decrease credit card fraud.

PCI Security Standard Council revealed the latest Data Security Standard version in May 2018. This version includes an enhanced list of operational and technical requirements, to ensure the highest level of the card data protection. Six main PCI DSS goals help to meet these requirements:

- Cardholder data protection

- Vulnerability management program maintenance

- Regular networks’ monitoring and testing

- Secure network & system maintenance

- Information security policy maintenance

- Strict access control measures implementation

When you choose a payment service provider for your online store, remember that PCI DSS compliance is a must. It ensures secure payment processing and safety of yours and clients’ transactions.

A certified payment processor will have an official PCI DSS mark.

2. Encrypt the payment page

You may know that from July 2018, Google marks websites without “https” encryption as “not secure” ones. But what you may not know, is that encryption level varies drastically depending on the industry. Why is it so? Let’s find out.

Since online media or information resources do not have payment pages, they can have entry-level SSL certificates like PositiveSSL, EssentialSSL, or InstantSSL.

Safety measures for governmental and health organizations, banks, and financial institutions are much higher. Websites that sell goods or services belong to this list as well and require a more secure payment protocol. This leads us to the next question. How to encrypt the payment page to meet the safety standards?

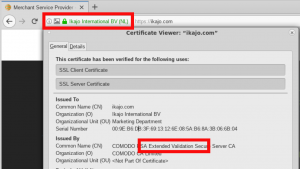

Opt for Organization Validation (OV) or Extended Validation (EV) SSL certificates. Not only do they carry out the high-volume of transactions, but they also require an in-depth business verification before the issue. Moreover, EV certificate has particular indicators like a padlock and your company name in green next to the https:// sign. As a result, customers know that you are using top-tier encryption straight away.

3. Prevent fraud

According to Experian, 90% of online users shop in digital stores. And 4 out of 5 consumers state that protecting personal and financial data is a top priority for a business. Nevertheless, 63% of business owners claim they have experienced the same or more fraud losses compared to 2018.

As a result, secure payment systems and fraud prevention become a pivotal part of every online store. Let’s learn what kinds of fraud business owners may face to prevent it.

There are two main fraud types:

- Identity fraud (identity theft). It’s a rather broad term, but we are specifically interested in credit card theft. In this case, a fraudster uses the data of the stolen or lost credit card to make a transaction without a legal card owner’s permission.

- Chargebacks (friendly fraud). When it comes to chargebacks, they are not always fraudulent. Still, some customers file for chargeback even though they have received goods or services. Moreover, some shoppers contact the issuing bank and claim they have never made such a transaction.

Even though 57% of business owners lean on IT companies to prevent fraud, they could not detect 67% of fraudulent activity with their technologies. That is why, instead of hiring a third-party company or creating your compliance department (which is very pricey), look for a PSP that offers fraud & chargeback prevention to its clients.

Take into account that not all PSPs have proven protection tools that let online merchants easily detect and stop fraudulent activity. Moreover, there is no guarantee that these tools are trustworthy. Opt for the PSPs that have their own fraud & chargebacks prevention software, as Ikajo International does.

4. Set two-factor authentication

Top companies like Google, Facebook, Yahoo, and others use two-factor authentication (2FA) to safeguard their users. We recommend following their example. When we are talking secure online payment for websites, 2FA is a tool that gives a more sophisticated level of protection to your customers.

How does two-factor authentication work?

– For entering an account

- The user fills in the username and password.

- The user receives an OTP code and enters it to prove one’s identity.

– For making a payment

- The user fills in the credit/debit card number, the cardholder name, the card expiration date, and CVV.

- The user receives an OTP via SMS or online banking application to prove identity.

42% of millennials said they would conduct more online transactions if there weren’t so many security hurdles to overcome.

Based on the quote, 2FA is a perfect option for an extra security layer, because it’s not too complicated. Still, it guarantees that only the account owner/cardholder accesses the account or makes a purchase.

5. Use tokenization

The last but not least way to secure credit card payment online is tokenization. Tokenization stands for replacing a primary account number with a sequence of randomly-generated numbers aka a token.

Why does the tokenization rule?

Because cybercrooks cannot “hack” the token. The process of tokenization is rather elaborate. But simply put, once token replaces the 16-digit card number, there is no way back. Crooks have no chance to reverse the process and get the initial card number. Moreover, each store uses different tokens to protect credit card data.

How does the tokenization work?

This is how a simplified process of tokenization looks like (based on Visa infographic): consumer initiates an online payment – an acquirer receives a token from the merchant – the acquirer routes the token to the payment network (e.g., Visa) – the payment network sends the token to a card issuer – the issuer returns the token and authorization – the acquirer receives the token and the authorization – the transaction is completed.

Conclusions

All-in-all, due to towering cybercrime losses, businesses are searching for state-of-art methods to secure online payments.

Nowadays, it is not enough to provide only a secure payment gateway. The whole system of payment processing should work for the enhanced security needs by combining the ways mentioned above.

We’d like to hear from you. Do you have experience of using the methods that we have offered? Or, maybe, you have another way that works for you.

Share your opinion by leaving a comment below. Let’s discuss how we take care of online transactions.