Once, the things we carry around and use on a day-to-day basis would have become props destined for use in a historical period series, not in reality. If you still pay using paper bills, it’s likely you won’t soon. Trends in payments will shift how we pay in the future, making today’s rulers – credit cards and cash – a thing of the past.

The future is calling – it’s high time we answered! Welcome to a whole new world with the hottest digital payment trends.

The most common trends for the future of payment processing

Cards and cash are still ruling the fintech infrastructure. However, there seems to be a growing popularity of mobile wallets – younger population darlings. The Millennials and generation Z literally cannot get enough of all types of innovations. They take the most out of emerging digital payment trends.

In 2015, mobile transactions amounted to a mere $550 billion. As eMarketer puts it, mobile commerce will make up 72.9% of the global e-commerce market.

As you can see, the latest payment industry trends all turn around the mobile commerce. But is there anything else?

The latest digital payment trends: what’s in there?

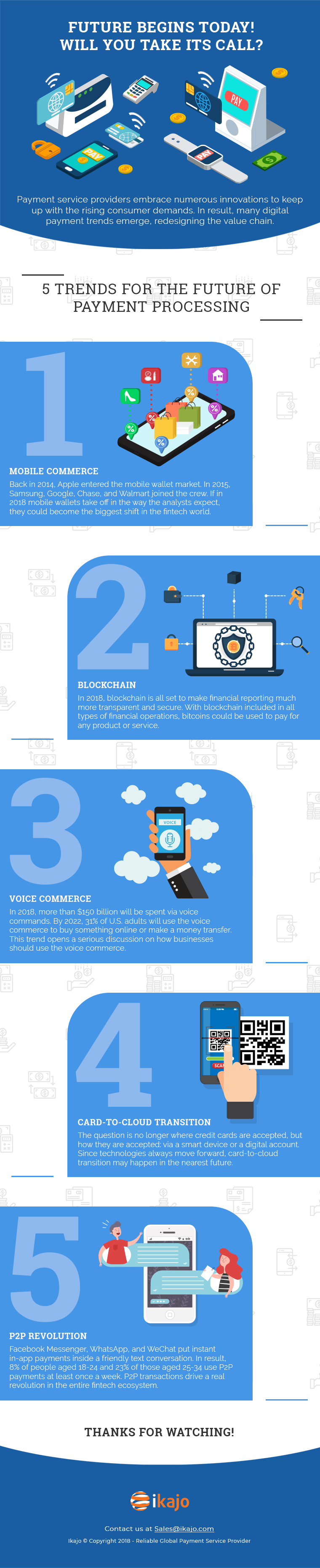

Payment service providers embrace numerous innovations to keep up with the rising consumer demands. In result, many digital payment trends emerge, redesigning the value chain.

Take a look at Digital Payment Trends of 2020 to learn more.

As a part of this shift, the ways we pay change dramatically. Payment services and products are being created, deployed, and used in line with the trends reshaping the payments ecosystem. Many of them have already made their way into headlines, but five in particular differ from the rest. For this reason, we discuss them here.

1. Mobile commerce

If mobile wallets take off in the way the analysts expect, they could become the biggest shift in the fintech world. This is particularly ripe for retailers. Using mobile wallets, they can enhance transactions and improve the overall shopping experience.

Back in 2014, Apple entered the mobile wallet market. In 2015, other big players joined the crew, catching the mobile wallet bug.

Samsung & Google:

Mobile Payment Soup: Samsung Launches Pay, PayPal Buys Paydiant, Google Wallet Returns 03/02/2015 http://t.co/aIILreOfxg

— Lyle Wetsch (@LyleWetsch) March 2, 2015

Chase:

#VENDS Chase coming to Microsoft Wallet next year? – In March 2015, Chase (the huge money center bank) withdrew… https://t.co/wcFMINbEgc

— World Mobile News (@WLN_Mobile) October 11, 2016

Walmart & others:

Giant combination of retailers sets launch of CurrentC mobile wallet for 2015 (GAP, Sears, 7-Eleven,Target, Walmart) http://t.co/qTNlUG04mn

— Mobilenik (@mobilenik) September 5, 2014

Restaurant owners don’t trail far behind the big players. With the emergence of quick service restaurants (QSRs), customers can get their meals fully prepared without going to the restaurant, visiting the nearest ATM, and taking out a wallet.

Burger King, Chipotle, and Starbucks have already tested a ‘quick order’ function. Customers enjoy in-app payments and continue using them on the go.

2. Blockchain

Yet another segment we can keep a close watch on is blockchain. This technology is one of the most promising trends in payments for 2020. With blockchain included in all types of financial operations, bitcoins could be used to pay for any product or service.

The blockchain is to watch out this year. In 2020, it’s all set to make financial reporting much more transparent and secure. That’s why the latest trends in payments industry fuel the growth of BTC and other cryptocurrencies.

3. Voice Commerce

Another trend that is promising to change how we pay in the future is voice commerce. Though yet it’s labeled as ‘coming soon’, it has the potential to transform the entire fintech landscape.

According to a trusted source, more than $150 billion will be spent via voice commands in 2020. Over the next 2 years, 30 billion IoT and connected devices will join the internet and create new payment channels.

8% of people already use voice commands to buy something online or make a money transfer. By 2022, this number is expected to grow into 31% of U.S. adults.

This way, voice commerce represents one of the top trends in payments. It opens a serious discussion on how businesses should use the voice commerce. Chatbots, in-home, and connected devices are already out there. Thus, voice-enabled commerce is a new major interface. It takes the latest trends in payments to a whole new level.

4. Card-to-cloud transition

Today’s world moves toward seamless digital transactions, letting you pay via whatever device you pick up. As trends in payments continue to evolve, so does the consumer technology.

Nowadays, an average customer spends 11 hours online daily, taking the most out of ‘instantism’ put right at his fingertips. Since technologies always move forward, credit cards are no longer enough for an average user. That’s the reason card-to-cloud transition may happen in the nearest future.

The question is no longer where credit cards are accepted, but how they are accepted: via a smart device or a digital account.

In 2017, Visa supported this trend by releasing an innovative solution – mVisa. This app allows you to pay for whatever you wish with no need to take your w̶a̶l̶l̶e̶t̶ credit card out! By scanning a QR code on your smartphone, you pay straight from your digital account into merchant’s card. This is what means convenience for the future-driven trends in payments.

P2P revolution

For most pockets of the population, lunch bills split between colleagues are often made with digital money, not paper bills.

With popular messaging platforms enabling e-commerce, virtual peer-to-peer transactions become real. Facebook Messenger, Line, WhatsApp, and WeChat give billions of their users the vibe of a new e-commerce – with instant in-app payments put inside a friendly text conversation.

As 451 Research Survey results show, 16% of people aged between 18 and 24 use P2P payments at least once a week. 23% of older respondents aged 25-34 do the same. It shows that P2P transactions drive a real revolution in the entire fintech ecosystem.

Trends in payments transform e-commerce

As you can see, payments reshape the world in terms of how, when, and where we pay. We can’t wait to see these trends win a top spot in a digital-driven future.

A multitude of gadgets and technologies are already involved in the process. Therefore, the future is coming… Will you take its call?