Have you ever heard of an EMV chip? What if we say it’s directly connected with the payment card you are using. Still, no clue? Well, it’s just a chip on your card. Yes, that simple.

Despite being a typical card attribute to customers, financial and bank professionals praise EMV-enabled cards for their safety. In this article, we are going to figure out what the EMV chip is, its pros and cons, and how it works.

What are the EMV card principles?

What is an EMV chip card?

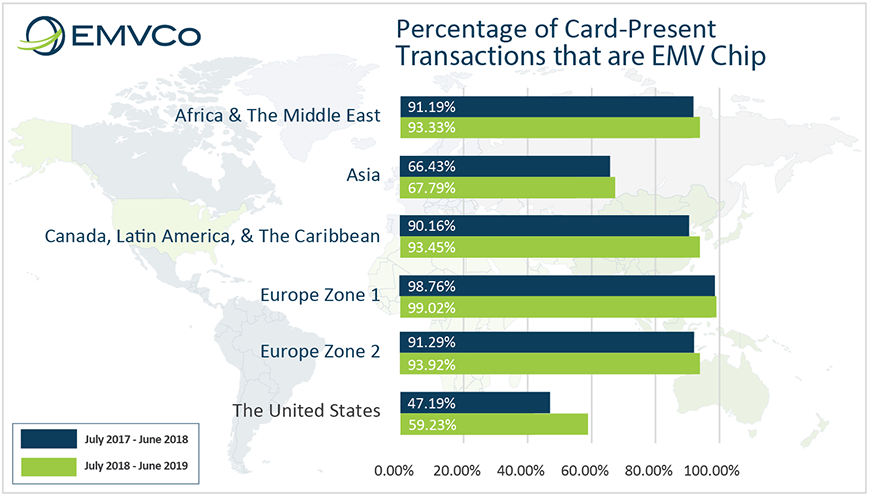

This notion appeared in the ’90s in Europe. The USA didn’t meet this technology eagerly at first. Anyway, after the card fraud level decreased across Europe, the United States accepted the standard as well. Anyway, what is the EMV chip definition?

EMV is an abbreviation of three organizations that took part in the standard creation – Europay, Mastercard, and Visa. A distinctive EMV feature lies in the fact that the payment application is placed in the secure chip. The chip, in its turn, is a part of the payment card.

The first standard’s publication date was 1996. Later, such industry giants as American Express, Discover, JCB, and others also embraced the technology. Besides, EMV chip cards may support both contactless and contact payments.

What are the EMV chip card features?

The payment card with a chip has three key features:

- possibility to complete processing

- opportunity to perform cryptographic processing

- option to securely store confidential information

Like any other card, the main goal of the microchip cards is to make a payment. As we’ve mentioned before, the EMV card can perform two types of payments contact and contactless. It may support both or only one of them. In order to make a payment, the chip connects to the chip-enabled reader. Then two scenarios take place.

- In the case of contact payment, the chip card has to make contact with an EMV chip card reader.

- During contactless payment, it’s possible to wave the card no further than 4 cm from the reader.

To make a payment at the point of sale, the customer needs to make sure the reader supports the chip cards.

EMV chip card processing

In this segment, let’s take a closer look at the chip processing. We are going to talk about two types separately, to define their differences.

Therefore, we need to mention that during the EMV transaction, the chip is responsible for data processing. Also, the chip is a source of the unity of rules that influence the outcome of the transaction. The terminal, in this case, is the supporting part of the procedure. It helps to enforce the set of rules. The rules include but are not limited to:

- authentification of the offline information

- verification of the card owner’s identity (via signature or PIN)

- online authentification

The chip rules define their final combination, and the issuing bank will use to approve the transaction.

EMV contact transaction

- Picking the application. The EMV chip can have one or more applications. Then the terminal and the chip pick the application they both support and agree to use it.

- Application processing and reading. The terminal reads the application it has chosen with the chip.

- Authentification of the offline information. The authentication takes place with SD Association, Dynamic Data Authentication, or Application Cryptogram Generation help.

- Restrictions’ check. The checks take place to confirm that the chip can perform the processing of the transaction.

- Card owner verification. The card owner verification takes place with the terminal-supported and chip-agreed method. It may be a signature, PIN, etc.

- Risk management. The terminal checks if there are sufficient requirements for online processing.

- Terminal check. Based on the previous steps, the terminal chooses the action – make the decline offline, accept offline, or proceed online.

- The chip’s response. Based on the rules the chip has, it answers the terminal with three outcome options – offline decline or approval or proceeding online.

- The transaction’s finalizing. If there is enough data to complete the transaction, it is confirmed with an “approved” or “declined” message.

- Online processing. The chip may request the processing to go online. Then the terminal builds the online connection. The request comes back with the issuer authentication, and the terminal sends it to the chip to make the approval.

EMV contactless transaction

The crucial difference between contactless and contact chip transaction is the speed. The main aim is to decrease the amount of time that the chip has to be held within the reader’s closeness. So, the data transmission between the reader and the chip is much faster.

EMV chip card benefits

Of course, payment cards with the microchip are versatile. Users can choose it for contact and contactless payments. Yet, the EMV chip’s most significant and the most vital benefit is security. There are special EMV elements that ensure protection and control. Consequently, that reduces lost/stolen card fraud and counterfeit.

Let’s take a look at how the EMV chip cards technology keeps up with the security assurance.

As you remember, there is a special application. Its full name is the application cryptogram. It is generated with the help of the two-factor 3DES cryptography. There may be two sources that generate this value. Either it is critical data from the online request or the final transaction leading to clearing and funds’ settlement.

The application cryptogram goal is two-parted.

- Authentication. Firstly, it’s essential to authorize the online card and issuer. The chip generates the request cryptogram. The chip sends it as a part of the authorization request during the online processing of the transaction.

- Signing. Following the rules, the chip signs the data components of the transaction to authorize it and to keep its integrity. There are four signatures the reader can receive after the authentication.

Moreover, the EMV card conveys an enhanced set of rights to the issuing bank. It has more control over the POS. That gives two safety benefits: 1) there’s less exposure to fraud; 2) decreased card risk.

On top of that, the chip generates one-time use only code for every transaction. The risk of fraudsters copying useful information or the code is itty-bitty.

Thanks to the variety of EMV card benefits, more and more users choose them to pay for goods/services.

What are EMV chip card drawbacks?

Despite the numerous pros, the standard has some cons. Mostly, those disadvantages are connected with concurrent expenses. So, the list of main drawbacks can look as follows:

- Employees education. As POS terminals that accept chip cards differ from the magnetic card readers, you need to train the workers.

- Speed. Although chip transactions are fast as well, they still need a few seconds more to complete one. That might frustrate the customers.

- Costs. The terminal price doesn’t vary that much. Nevertheless, the updating may be rather pricey.

These reasons may turn merchants away from dealing with EMV chip cards.

Conclusions

As you can see, the EMV is a specific standard. Europay, Mastercard, and Visa have created it to provide better security to card-present payments. The extended protection lies in the fact of how the chip stores and processes the data.

The card that has a chip in addition to the magnetic stripe and NFC technology is, by far, the most advanced offline payment method the customers can enjoy.