We’re pleased to announce that we continue exploring payment processing in various industries. We’ve already covered online dating, web hosting, and gambling. Besides, we explained what steps one has to take to apply for a payment gateway on his website. Finally, today we’re going to cover budgeting software and payment processing. for budgeting software.

Sounds interesting? Then keep on reading.

The rise of the behavioral economics

Before we dive into details of payment processing for budgeting software, we need to understand why it suddenly became so popular after all.

Here is a fun fact: CNBC reports that according to their study impulsive purchases account for $5,400 of a budget of an average US citizen. They state that “The study of 2,000 consumers shows they make three of those purchases a week, adding up to $450 a month and $5,400 per year. Most of the spur-of-the-moment outlays go toward food, with 70.5 percent of respondents saying that category was the major culprit.”

“Well,” you might think, “that’s a whole lot of money!” And you’ll be 100% right. Impulsive purchases can be a real pain in the neck. That is why more and more people are willing to make conscious decisions when it comes to shopping, both online and offline. As a result, behavioral economics came into being.

What is behavioral economics?

Scientifically speaking, behavioral economics is the science that “studies the effects of psychological, cognitive, emotional, cultural and social factors on the economic decisions of individuals.”

In other words, this science aims to explain what drives your economic decisions, what triggers people to purchase things they don’t really need, and what effect these economic decisions have on one’s life.

Why use budgeting software

According to prominent behavioral economists, one of the most effective solutions that can prevent spur-of-the-moment buys is budget planning. No wonder so many budgeting apps come on stage these days.

Among the most popular ones are:

- Money Lover;

- Mint;

- Wallet;

- Pocketguard;

- Spendee;

- Mvelops;

- Goodbudget;

- You Need a Budget (YNAB), etc.

If you have the tendency to make impulsive buys, it is only smart to download one of these apps and make good use of it. Meanwhile, let’s talk about budgeting software payment processing.

Payment processing for budgeting software

Part of these apps is free, others charge a certain fee for using them or their advanced features. But in general, they can be classified into two groups according to their payment processing needs: those that work on the subscription model, and those that require one-time payments.

Naturally, these two groups of apps expect a different set of features and services from the payment processor. So, let’s look into each one of them.

Subscription-based apps

Subscription-based budgeting apps typically offer a short free trial period. Its main goal is to allow the users understand whether this app lives up to their expectations and has all the features they need for their budget planning. If so, then he can subscribe to the app and have his card charged every week/month/year an agreed amount of money.

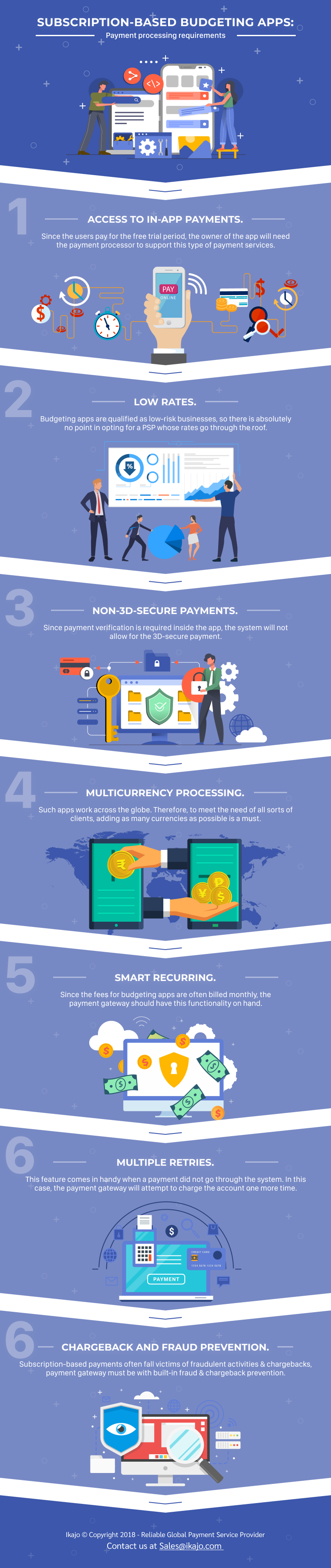

Here is a list of services they expect the payment processor to offer them:

- Access to in-app payments.

Since the users pay for the free trial period, the owner of the app will need the payment processor to support this type of payment services. - Low rates.

Normally, such merchants expect the payment processor to offer them the lowest rates possible. They are qualified as low-risk businesses, so there is absolutely no point in opting for a PSP whose rates go through the roof. - Non-3Dsecure payments.

Since payment verification is required inside the app, the system will not allow for the 3Dsecure payment. - Multicurrency processing.

Such apps work across the globe. Therefore, to meet the need of all sorts of clients, adding as many currencies as possible is a must. - Smart recurring.

We’ve already talked about this type of recurring payments. To read more about it, take a look at our “Web hosting payment processing” article. - Multiple retries.

This feature comes in handy when a payment did not go through the system. In this case, the payment gateway will attempt to charge the account one more time. - Chargeback and fraud prevention.

Since subscription-based payments often fall victim to fraudulent activities and chargebacks, it is essential for the merchants to choose a payment gateway with built-in fraud and chargeback prevention systems.

Apps with regular payments

The other type of apps offers a limited set of features free of charge with an opportunity to purchase add-ons.

The owners of such apps expect the payment processor to provide them with:

- Access to multicurrency retries.

As with the previous type of apps, they work with clients from all over the globe. For their convenience, they must be able to send and receive payments in various currencies. - 3D secure.

This feature helps them keep their payments safe. And since security is the number one concern of consumers worldwide, having additional protection system automatically increases clients’ trust to the merchant. - In-app payments.

An ability to pay for services right inside the app without necessarily leaving the app is essential for the success of this particular app. Therefore, PSPs willing to attract as many merchants to their services as possible should provide this feature too. - Alternative payment methods.

Depending on the geo of the app’s target audience, merchants will require different payment methods. And the more of them a PSP can offer, the better. - Conversion rate up to 98%.

It is essential for merchants to have a high payment conversion rate. Most of them claim that they would opt for a PSP whose rate is at least 98%. - Low rates.

Since this type of business is also considered low-risk, they are not ready to pay high rates. So, to be their first choice payment processors should make their rates as low as possible. - One-click payment.

Users are used to instant payments, and merchants outperform themselves trying to offer them what they expect. As a result, PSPs that have instant payments feature are the top choice of payment processors.

Over to you

We can say for sure that it is the golden age of budgeting software. Apps helping people to plan and save money are here to stay. So, PSPs should be ready to offer proper payment processing to app owners. See what proper payment processing means in this guide. We’ll see you next week with yet another industry’s payment processing principles explained.